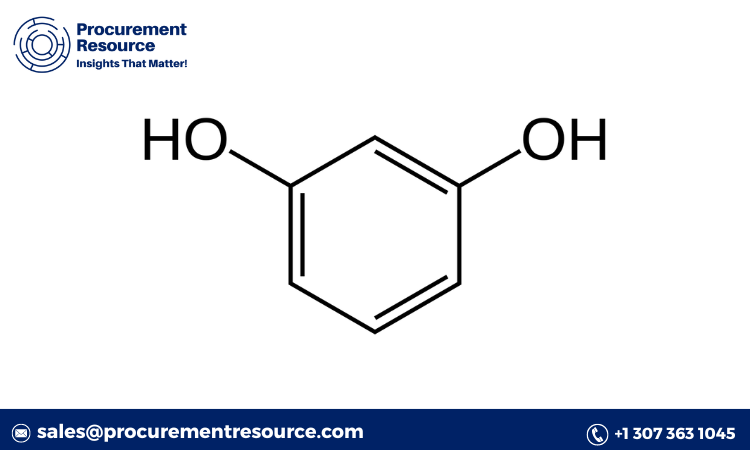

Phenol, a highly versatile industrial compound, plays a crucial role in producing resins, adhesives, and plastics. Over the years, its demand has steadily increased across diverse industries, including automotive, construction, and consumer goods, making phenol a vital component in various manufacturing processes. Tracking its price trend is essential for industries and stakeholders reliant on phenol-based products. This report provides an in-depth analysis of the phenol price trends, factors influencing its pricing, and a forecast for the upcoming years.

Overview of the Phenol Market

The phenol market is characterized by its integration within several industrial sectors. Due to its applications in resins, paints, coatings, and the production of bisphenol-A (BPA), which is a precursor for polycarbonate and epoxy resins, phenol remains a highly demanded chemical compound. The global market dynamics of phenol are closely tied to industrial activity and the health of the global economy, with key regions such as North America, Europe, and Asia-Pacific leading in both production and consumption.

Phenol Price Trends in Recent Years

In recent years, the phenol market has seen notable fluctuations. Between 2020 and 2023, for instance, the price trend reflected the impacts of both macroeconomic and sector-specific factors:

Request For Sample: https://www.procurementresource.com/resource-center/phenol-price-trends/pricerequest

- Pandemic Impact (2020-2021): COVID-19 led to a slowdown in industrial activity, which affected demand for phenol across various applications. The restricted production and supply chain disruptions caused a temporary dip in phenol prices. However, as industries gradually reopened, prices began to stabilize and climb as demand recovered.

- Supply Chain Constraints (2022): The post-pandemic recovery period was marked by global supply chain issues, particularly in raw material sourcing and transportation. This increased operational costs, and in turn, phenol prices surged. The price increase was exacerbated by higher energy costs, which have a direct impact on the production costs of phenol.

- Geopolitical Tensions (2022-2023): Geopolitical conflicts, notably in Europe, had ripple effects across global markets, affecting the availability and cost of raw materials like benzene, a key precursor for phenol. This led to increased prices in both raw materials and phenol itself, pushing manufacturers to pass on the additional costs to end consumers.

- Inflationary Pressures (2023): With inflationary pressures continuing in major economies, operating costs for phenol manufacturers rose. This has contributed to a sustained increase in phenol prices, though the market has also shown signs of stabilization as inflation rates begin to moderate.

Key Factors Influencing Phenol Prices

Several factors play a pivotal role in shaping the phenol price trends. Understanding these can provide valuable insights for stakeholders looking to navigate the phenol market effectively.

- Raw Material Costs: The production of phenol primarily involves benzene and propylene, both of which are subject to their market volatilities. Fluctuations in the benzene market, driven by crude oil prices, directly impact phenol production costs and, consequently, its market prices.

- Energy Costs: As an energy-intensive production process, phenol manufacturing is highly sensitive to changes in energy costs. Rising energy prices, as seen in recent years, lead to higher production expenses for manufacturers. In regions like Europe, energy crises have created further unpredictability, influencing phenol prices significantly.

- Demand-Supply Dynamics: The phenol market’s balance between supply and demand is crucial. Factors like production capacity expansions, shutdowns, or disruptions affect supply levels. Additionally, strong demand from downstream industries, such as automotive, electronics, and construction, influences the phenol price. Periods of high demand often correlate with price increases, while oversupply situations can result in price drops.

- Geopolitical Events: Global conflicts and trade restrictions impact raw material availability and production costs. Import-export restrictions or tariffs in key producing regions can disrupt the phenol supply chain, leading to increased prices in affected markets.

- Regulatory and Environmental Policies: Stricter environmental regulations, especially in developed countries, affect phenol production costs. Companies are compelled to invest in cleaner technologies and adhere to emission norms, which raises operating expenses and impacts phenol prices.

Regional Phenol Price Trends

Phenol prices exhibit regional variations based on factors like raw material availability, demand from downstream industries, and regional economic policies.

- Asia-Pacific: This region, particularly China and India, leads in phenol production and consumption. Asia-Pacific prices are generally competitive, driven by strong domestic production capacities and high demand from industries like automotive and construction. However, environmental regulations and shifts in energy policies in countries like China may lead to price increases.

- North America: The U.S. is a major producer and consumer of phenol, with its price trends influenced by local demand and energy costs. The shale gas revolution has offered cost advantages to U.S. phenol manufacturers in the past, but recent increases in energy costs and raw material prices have driven up phenol prices in the region.

- Europe: European phenol prices are relatively high due to stringent environmental policies and volatile energy costs. The ongoing transition to cleaner energy sources, while beneficial in the long term, has resulted in temporary price surges due to supply constraints and higher production costs.

Forecast for the Phenol Market (2024-2028)

Given the market trends and influencing factors, the following predictions can be made for the phenol market in the upcoming years:

- Demand Recovery: The global phenol demand is expected to grow moderately, driven by a continued recovery in industries such as automotive and construction. The increasing use of phenol in electronic goods and healthcare products is likely to support steady demand growth, contributing to stable price trends.

- Stable Raw Material Prices: As crude oil prices stabilize post-2023, benzene prices, and consequently phenol production costs, are anticipated to level off. This should lead to more predictable phenol prices, barring unforeseen geopolitical or economic disruptions.

- Technological Advancements: The adoption of energy-efficient and environmentally friendly production processes will potentially reduce production costs in the long run. This transition could help mitigate price hikes associated with rising energy and raw material costs.

- Regional Price Variances: Asia-Pacific is likely to remain a price-competitive region, thanks to robust production capacities. However, Europe may continue to see higher prices unless energy costs stabilize. North America’s price trend will largely depend on local energy and regulatory developments.

Phenol prices have experienced significant fluctuations in recent years due to various factors, including global economic conditions, energy costs, and regional policies. Looking ahead, while phenol prices are expected to stabilize, stakeholders should remain vigilant about raw material trends, energy costs, and potential disruptions in the supply chain. Companies that can adapt to these trends through efficient resource management and cost-effective production methods will be better positioned to manage price risks in the phenol market.

For industry players, understanding these trends is essential for strategic planning, procurement, and pricing decisions. By staying informed and agile, businesses can better navigate the phenol market’s complexities and capitalize on opportunities within this essential industrial segment.

Contact Us:

Company Name: Procurement Resource

Contact Person: Endru Smith

Email: sales@procurementresource.com

Toll-Free Number: USA & Canada - Phone no: +1 307 363 1045 | UK - Phone no: +44 7537171117 | Asia-Pacific (APAC) - Phone no: +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA